Your insurance firm will certainly employ an appraiser to appraise your automobile. If you do not hire your very own appraiser, after that the insurance coverage business will certainly pay you what they consider is ideal.

If the appraisers are not able to concur, after that a 3rd event called an "examination umpire" will certainly then pay attention to both sides and also make a resolution as to which evaluator is right regarding the vehicle's value. State regulation requires both sides to share the price of an evaluation hearing similarly. For the most part, an assessment hearing costs about $500 ($250 per side), which mosts likely to pay the assessment umpire - low cost auto.

If your insurance provider rips off 10,000 insurance policy holders out of $1,000 each, the insurance provider conserves $10,000,000. It is not uncommon for the larger providers (Farmers, Mercury, Allstate, and so on) to fix 10s of hundreds of total-loss insurance claims annually. The insurance provider have substantial incentives to reduce the quantity insurance policy holders are owed paid on their case.

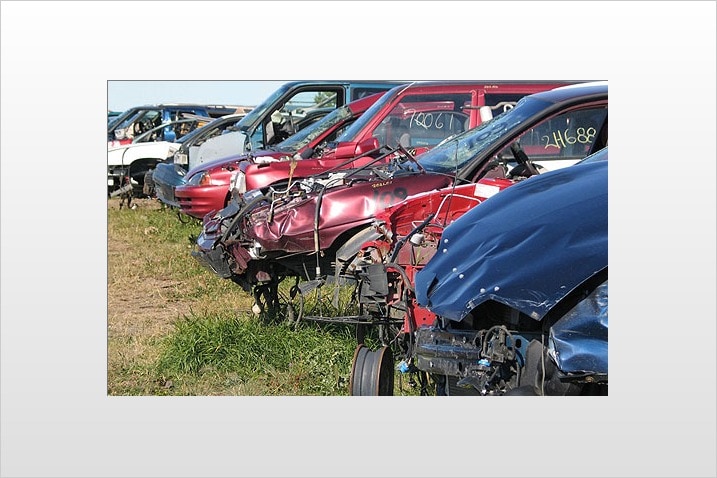

If you have full coverage vehicle insurance policy, your plan might pay you for the value of your lorry if it is completed because of a covered loss - cars. Shedding your car to a failure can be stressful, yet comprehending exactly how the process functions and also understanding just how to obtain more for your failure lorry settlement could help you set practical expectations for the procedure.

Exactly how to work out with car insurance insurers regarding a vehicle overall loss, When you sue on your auto insurance plan, your instance will likely be designated to a claims insurance adjuster. The insurance adjuster's job is to assess the facts of the loss, establish what insurance coverages apply, pay out the ideal quantities and also clear up the insurance claim.

If you are asking yourself exactly how to discuss with an insurance coverage adjuster during a car total loss insurance claim, there are some actions you can comply with. Determine what the vehicle deserves, Among the primary steps in failure settlement negotiation is figuring out the value of your vehicle - low cost auto. This will certainly depend upon various aspects, consisting of the year, make and model of your lorry, any upgrades to the body design, the amount of miles the vehicle has and also its physical condition.

Some Ideas on Total Loss Car Accident Class Action Lawsuit - Shamis ... You Should Know

Yet if you simply require a ballpark figure, there are online devices that you can use to identify your car's value. Decide if the initial offer is as well low, There might be no need to discuss with your insurance claims insurer if the first payment offer for your vehicle is adequate (insurance companies).

Employ a lawyer, If your negotiations with the insurance claims insurer confirm unsuccessful, you might hire an attorney. Although this is most likely to be taken into consideration a last resource, lawsuits can help you obtain the negotiation that you feel that you are entitled to. It could additionally aid to ease a few of the stress surrounding total loss arrangements.

Obtain a composed settlement contract, Once you get to a settlement with the insurance firm, you might intend to validate the terms in creating. This helps guarantee that everybody settles on the settlement quantity and protects both events by proving that the insurer consents to pay a certain quantity as well as that you consent to that quantity. insurance.

Can I keep my auto if it is a total loss? In a normal complete loss negotiation, you are paid for the value of the vehicle, which implies the automobile ends up being the legal property of the insurance policy company - cheapest car insurance.

This can be pricey and there is no warranty that an independent insurance adjuster will certainly value your vehicle more highly than an adjuster from your insurance coverage firm.

State law could call for an insurance company to amount to a car when the price to repair it is much more than 75% of the cars and truck's ACV. Various other states may set the limit lower or greater - money. States without a tender loving care usually evaluate the price to fix and salvage a vehicle against the cars and truck's ACV.

The Best Guide To Car Insurance Claims Do's & Don'ts - Salvilaw.com

Allow's say you live in a state where legislators set the complete loss limit at 60%. If your technician says repairs will set you back $2,880 or even more, the insurance firm will likely total your vehicle.

Your Alternatives After Your Auto is Completed An overall loss insurance policy case is normally much more complicated than getting a vehicle repaired. Recognizing what to do as well as what your choices are can aid you accelerate the insurance policy claim process and obtain the most effective outcome feasible. 5 Steps to Take Right After Your Cars And Truck is Totaled The majority of failure accidents are pretty major.

When the shock of the mishap has actually passed, you ought to: Failure claims can take a long period of time to procedure, so call your insurance provider and the insurance provider of any type of other individual or entity included in the crash immediately. As an example, if one more vehicle driver hit you, contact your insurer which vehicle driver's insurance firm to report the crash.

The store will give your adjuster a price quote for repairs and the insurance adjuster will choose whether to total the vehicle. You'll need to provide the insurance provider with your auto's title. If you don't have it, you can request a duplicate from the Division of Motor Automobiles in your state.

Assume meticulously regarding whether it makes monetary sense to keep a totaled cars and truck. You'll require to have it repaired, evaluated, and also reinsured to get the auto back on the roadway.

Suppose I Wished to Total Amount the Vehicle however the Insurance Company Does Not? You can ask the insurance provider to complete your auto, however insurance firms inevitably decide whether to total a cars and truck based on the car's market value and also the degree of the damages - cheaper cars. Do You Pay a Deductible When Your Auto is Amounted to? You may have to pay your deductible for an amounted to automobile.

Getting The How To Fight An Insurance Company Over A Totaled Car To Work

Generally, a deductible is a collection buck amount. As an example, if the ACV of your totaled cars and truck is $5,000 as well as you have a $1,000 deductible, your insurance company will certainly pay out $4,000 ($5,000 - $1,000 deductible). You might not need to pay the deductible if you aren't responsible for the mishap that totaled your car.

, your liability insurance coverage compensates various other individuals for their injuries and also damage to their residential or commercial property. If your cars and truck was completed in a mishap that had not been entirely your fault, you can file a third-party claim under obligation insurance coverage with the other vehicle driver's or automobile proprietor's insurance policy company.

Comprehensive Coverage Comprehensive insurance coverage covers damages that isn't brought on by a crash with another car. If your automobile is amounted to by a fire, a fallen tree, or severe weather, your thorough insurance coverage protection will likely begin. Comprehensive insurance coverage also may cover damage caused by striking a pet while driving depending on your plan.

If you have an accident with an underinsured or without insurance driver, you may be able to obtain compensation for your totaled car from your without insurance vehicle driver protection (UIM), if you have it - laws. The Bottom Line on Who Pays The bottom line is that the various other motorist's or automobile owner's insurance company will certainly pay for your totaled vehicle if the various other chauffeur was at mistake for the accident (irresponsible).

vehicle insurance vehicle cheaper car insurance suvs

vehicle insurance vehicle cheaper car insurance suvs

If the at-fault vehicle driver is underinsured or uninsured, you'll need to rely on your collision or UIM insurance coverage. If you created the mishap, your responsibility protection will pay other people for their injuries and damages to their home, yet you'll need to depend on your collision insurance coverage to pay for your completed car - money.

Find out more regarding what happens when you remain in an automobile mishap and also without insurance. Just How Much Will Insurance Spend For My Totaled Car? Each type of insurance coverage coverageliability, crash, detailed, UIMhas its own plan limits. The plan limitation is the complete amount the insurance firm will pay for a solitary mishap or case.

The Basic Principles Of The Insurance Company Is Not Paying Me Full Value For My ...

insurance companies insurance business insurance trucks

insurance companies insurance business insurance trucks

Your car's AVC is $25,000, however the at-fault driver has only $10,000 of residential or commercial property liability coverage. That driver's insurer will pay only $10,000 toward your failure settlement. The only means for you to get the remaining $15,000 of your vehicle's ACV would certainly be from your very own collision protection or underinsured motorist coverage (cheap insurance).

If you possess the automobile, the insurance coverage business will pay you straight. If your vehicle is funded, the insurance company will pay your lender.

trucks affordable low cost auto cheap car

trucks affordable low cost auto cheap car

Timeline for a Failure Negotiation The quantity of time it requires to settle a failure vehicle accident situation varies from a few weeks to lots of months. The timing relies on just how quickly you file your insurance claim, just how very easy it is to identify that was at fault for the crash, state legislations, as well as whether legal representatives are entailed in the negotiations.

The real cash worth of your vehicle is just $12,000. The insurance firm is just going to pay you $12,000, leaving you with a balance of $2,500 to pay on your finance for an auto you can no much longer drive.

risks vehicle insurance affordable auto insurance car insurance

risks vehicle insurance affordable auto insurance car insurance

When you're financing a car, you don't possess it, the bank does. As you repay your auto loan, you will typically owe more than your auto is presently worth as a result of vehicle loan rates of interest and also depreciation. Void insurance covers the difference ("space") in between what you still owe on your financed car and the automobile's ACV.

As soon as you have actually found out your lending payback amount and the amount the insurance provider intends to spend for the loss, you can determine just how much cash you will have to place down on your following cars and truck (suvs). If you are stuck owing cash for an amounted to automobile, your loan provider could be able to consolidate what you owe into a brand-new auto loan.

Some Known Details About How To Appeal A Car Insurance Claim Decision

If you have inquiries about your rights as well as choices, talk to a car accident attorney. A lawyer can answer your concerns, bargain with insurers, as well as represent you in court if essential - cheap. It's worth the expense of working with a legal representative when you don't really feel the insurer is supplying a reasonable settlement for your completed auto.

You can likewise link with a lawyer directly from this web page free of cost.

Yet the real money value of your automobile is just $12,000. The insurance provider is only going to pay you $12,000, leaving you with an equilibrium of $2,500 to pay on your lending for an automobile you can no longer drive. Discover more concerning what occurs when you still owe cash on an amounted to cars and truck (car insured).

When you're funding an automobile, you do not own it, the financial institution does. As you settle your vehicle loan, you will certainly typically owe more than your cars and truck is currently worth due to cars and truck finance rates of interest and depreciation (business insurance). Space insurance covers the distinction ("void") between what you still owe on your financed auto and the vehicle's ACV.

Once you've identified your finance reward amount as well as the quantity the insurance provider means to pay for the loss, you can calculate exactly how much money you read more will certainly have to place down on your following automobile. If you are stuck owing cash for a completed car, your lending institution could be able to combine what you owe into a new auto lending.

If you have questions concerning your civil liberties and also options, talk to a vehicle mishap attorney. A legal representative can answer your inquiries, negotiate with insurance firms, and represent you in court if needed. It deserves the expenditure of hiring a legal representative when you don't really feel the insurance firm is supplying a reasonable negotiation for your totaled vehicle.

About Tips For Negotiating The Actual Cash Value Of Your Car

trucks cars cheapest car car

trucks cars cheapest car car

You can likewise attach with a lawyer directly from this web page completely free. cheap car.